Soundstage Filming Tax Credit Program

The California Film Commission administers the Soundstage Filming Tax Credit Program. Under Senate Bill 144, for taxable years beginning on or after January 1, 2022, and before January 1, 2032, the Soundstage Program would allow a tax credit in an amount equal to 20% or 25% of qualified expenditures for the production of a qualified motion picture in this state at a certified studio construction project.

Interested applicants shall contact Soundstage Tax Credit Program for questions.

$150 Million Allocation

Allocated to qualified production entities with projects filming on certified soundstages.

Soundstage Certification

A construction or renovation project must meet a set of criteria defined by the CFC in order to be a certified studio construction project.

Diversity Requirement

The program requires all projects to submit diversity workforce plans and allocates additional tax credits.

NOTICE OF PROPOSED RULEMAKING ACTION

March 15, 2024 – Notice is hereby given that the California Film Commission (CFC) proposes to amend the regulations described below after considering all comments, objections, and recommendations regarding the proposed action. The CFC proposes to amend section 5541 in Article 4 of Chapter 7.75 of Title 10 of the California Code of Regulations in order to implement, interpret and make specific Revenue and Taxation Code sections 17053.98, and 23698 relating to a film and television tax credit program. No public hearing is scheduled; however, any interested person or their duly authorized representative may request a public hearing no later than fifteen (15) days prior to the close of the public comment period. Any interested person, or their authorized representative, may submit written comments relevant to the proposed regulatory action to the Agency. Written comments will be accepted by the Agency until 5:00 p.m. on April 30, 2024.

On February 8, 2024, the Office of Administrative Law (OAL) approved, and the Secretary of State endorsed the California Film Commission’s rulemaking action numbered 2023-1226-01C. These are the regulations currently in effect, amending previously adopted regulations implementing Sections 17053.98 and 23698 of the Revenue and Taxation Code and governing the California Soundstage Filming Tax Credit Program. The 45-day public notice period was held between September 15 and October 31, 2023, and a 15-day re-notice period for public comment was held between November 7 and November 22, 2023.

NOTICE OF PROPOSED RULEMAKING ACTION

March 15, 2024 – Notice is hereby given that the California Film Commission (CFC) proposes to amend the regulations described below after considering all comments, objections, and recommendations regarding the proposed action. The CFC proposes to amend section 5541 in Article 4 of Chapter 7.75 of Title 10 of the California Code of Regulations in order to implement, interpret and make specific Revenue and Taxation Code sections 17053.98, and 23698 relating to a film and television tax credit program. No public hearing is scheduled; however, any interested person or their duly authorized representative may request a public hearing no later than fifteen (15) days prior to the close of the public comment period. Any interested person, or their authorized representative, may submit written comments relevant to the proposed regulatory action to the Agency. Written comments will be accepted by the Agency until 5:00 p.m. on April 30, 2024.

On February 8, 2024, the Office of Administrative Law (OAL) approved, and the Secretary of State endorsed the California Film Commission’s rulemaking action numbered 2023-1226-01C. These are the regulations currently in effect, amending previously adopted regulations implementing Sections 17053.98 and 23698 of the Revenue and Taxation Code and governing the California Soundstage Filming Tax Credit Program. The 45-day public notice period was held between September 15 and October 31, 2023, and a 15-day re-notice period for public comment was held between November 7 and November 22, 2023.

Soundstage Program Guidelines

The Program Guidelines were prepared to assist production companies and taxpayers in utilizing the California Soundstage Filming Tax Credit Program. It is intended to add clarity to certain provisions of the statutes and contains details of the regulatory requirements related to the Soundstage Filming Tax Credit Program. Applicants should read and understand the Program Regulations and the requirements of Senate Bill 144, any subsequent amendments to the relevant Sections of the Revenue and Taxation Code, and are strongly advised to consult with their legal and financial advisors.

Soundstage Program Guidelines

The Program Guidelines were prepared to assist production companies and taxpayers in utilizing the California Soundstage Filming Tax Credit Program. It is intended to add clarity to certain provisions of the statutes and contains details of the regulatory requirements related to the Soundstage Filming Tax Credit Program. Applicants should read and understand the Program Regulations and the requirements of Senate Bill 144, any subsequent amendments to the relevant Sections of the Revenue and Taxation Code, and are strongly advised to consult with their legal and financial advisors.

Application Process

The California Soundstage Filming Tax Credit Program requires the applicant to submit the application form for Phase A and provide a third-party Certified Studio Construction Project

Verification Report performed by a CPA firm.

Once completed, Phase B Application for the qualified motion picture production must be submitted to the

California Film Commission.

Application Process

The California Soundstage Filming Tax Credit Program requires the applicant to submit the application form for Phase A and provide a third-party Certified Studio Construction Project Verification Report performed by a CPA firm.

Once completed, Phase B Application for the qualified motion picture production must be submitted to the California Film Commission.

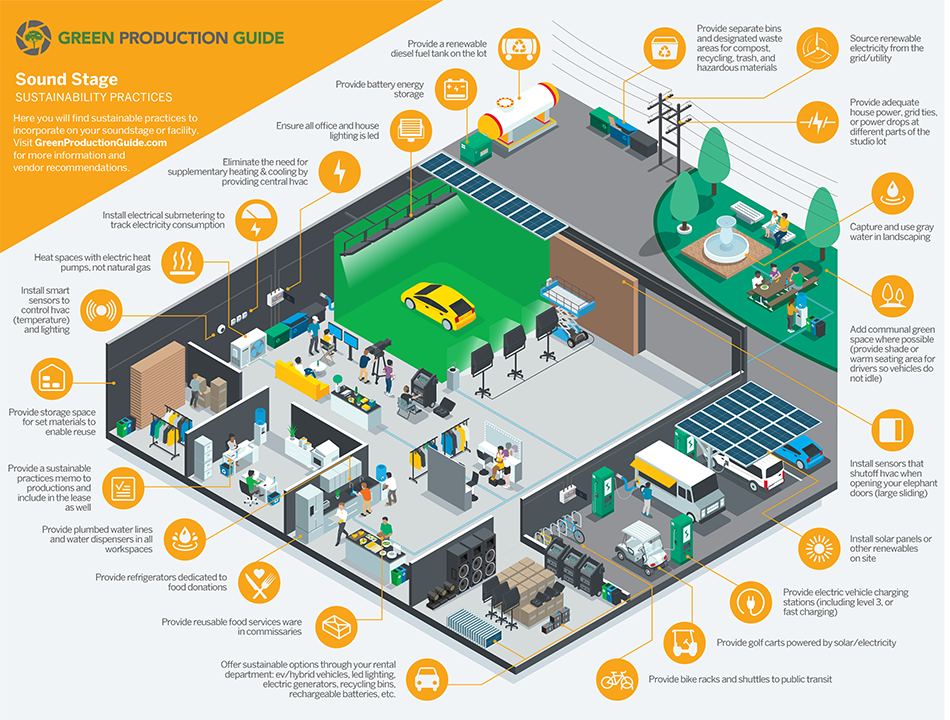

Soundstage Sustainability Practices

Visit Sustainability & Filmmaking for additional resources on how to reduce production carbon footprint.

Additional Resources

Phase A Application PDF (For reference use only)

Phase B Application PDF (For reference use only)

CPA Checklist – CSCP Verification

CPA Checklist – Annual Workforce Report

Certified Public Accountant List

SFP Budget Tagging & Tracking Tips

SFP Qualified Expenditures Chart

Additional Resources

- Phase A Application PDF (For reference use only)

- Phase B Application PDF (For reference use only)

- CPA Checklist – CSCP Verification

- CPA Checklist – Annual Workforce Report

- Certified Public Accountant List

- SFP Budget Tagging & Tracking Tips

- SFP Qualified Expenditures Chart

- Revenue and Taxation Code Reference Key

- Frequently Asked Questions

The Program Guidelines, forms, and other application materials are currently being developed by the CFC. Sign-up to receive the latest updates and information about the Soundstage Filming Tax Credit Program.

California Film Commission

7080 Hollywood Blvd., Suite 900

Los Angeles, CA 90028

Tel: 323.860.2960 | 800.858.4749

Email the CFC | About Us

Newsletters

Production Alerts

Soundstage Alerts

CFC Board Notices Sign-Up

Careers

Download the Cinemascout app!